Battery Testing

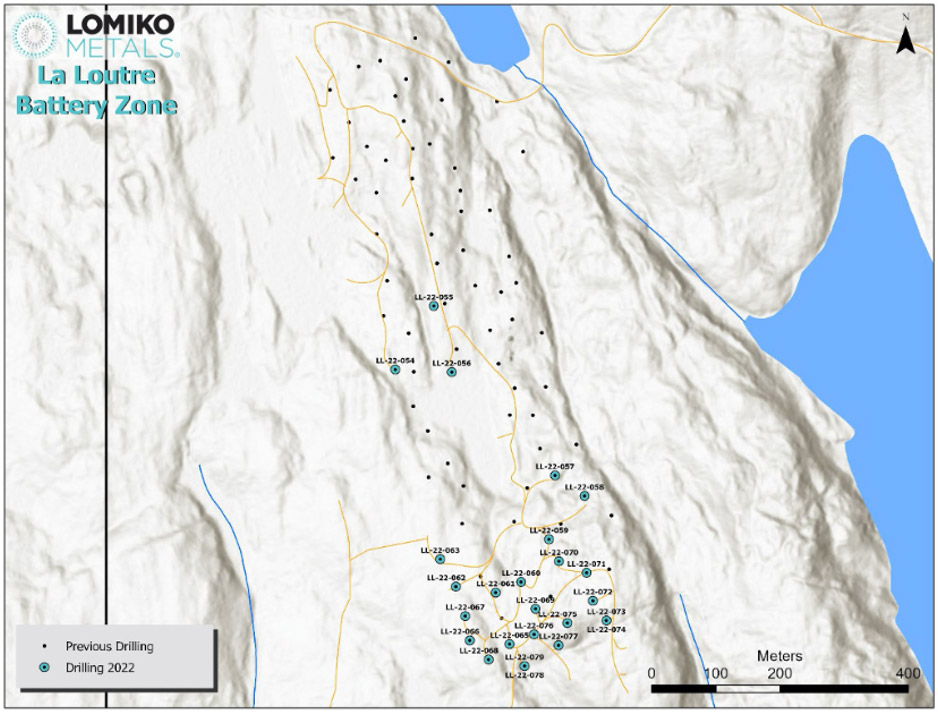

La Loutre Metallurgical Studies and Battery Trials

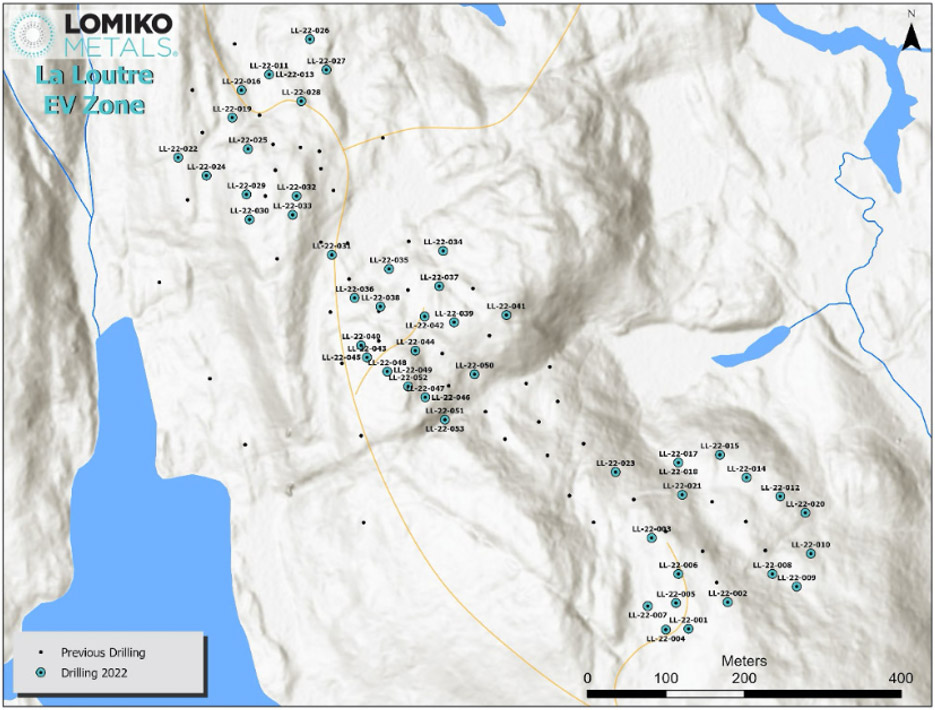

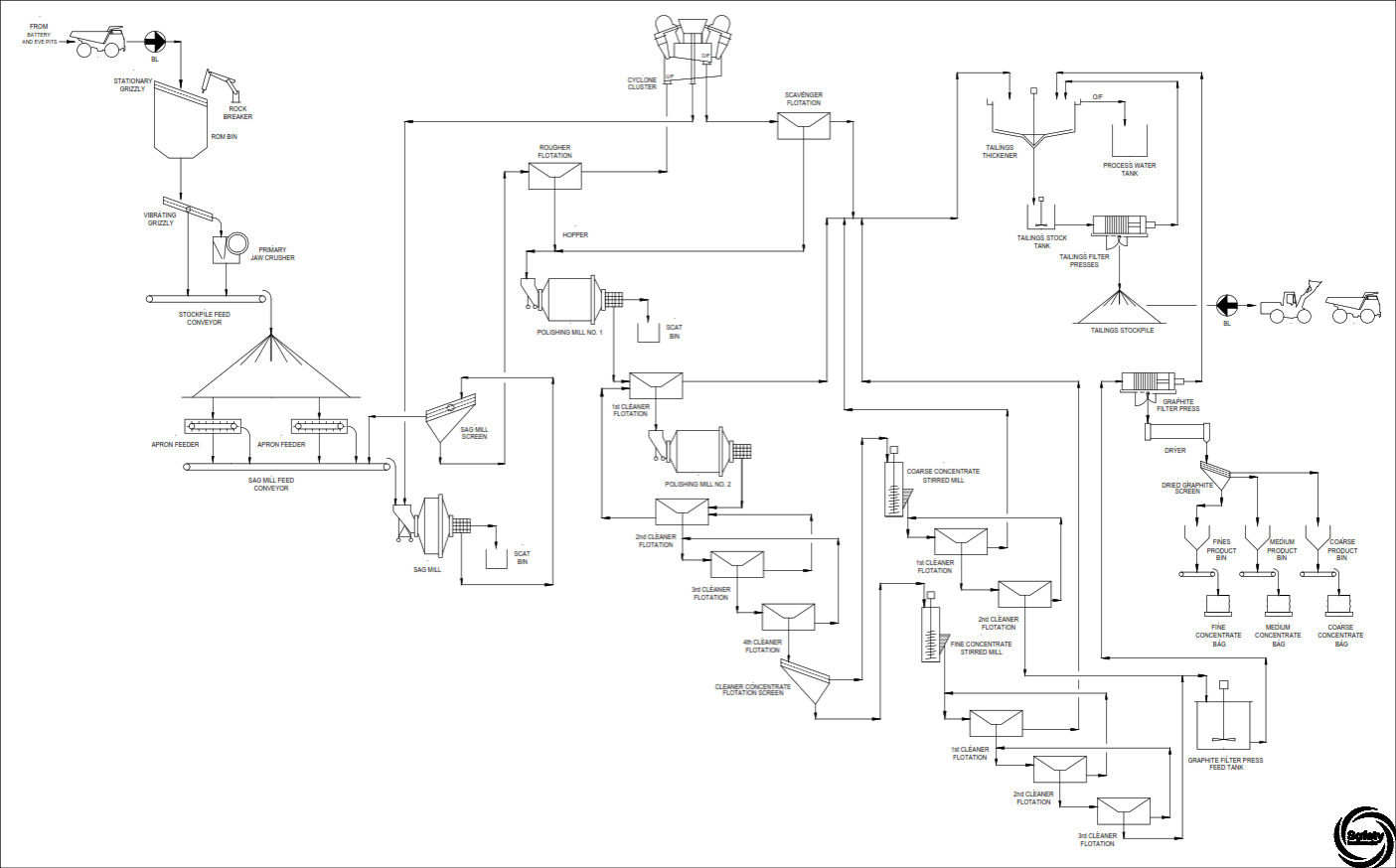

Lomiko has successfully completed half-cell coin battery testing of its La Loutre graphite material with Polaris Battery Labs, LLC (“Polaris”). Polaris prepared La Loutre’s coated spherical purified graphite (cSPG) material from flotation concentrate samples and subjected it to half-cell coin testing to determine its basic material electrochemical performance metrics. The total mass of cSPG provided was approximately 160g and originated from coated purified samples generated by the Corem Innovation Centre in Quebec, Canada. These samples were micronized and spheronized by ProGraphite in Germany. The samples are deemed representative of the La Loutre deposit. Polaris will continue the test program in 2024.

These initial results from half-cell battery testing (“the Polaris Study”) confirm excellent graphite properties as detailed below, thus providing conditions for Lomiko to progress into Phase 2 project activities to produce and test single-layer pouch cells; these are full cells using our graphite anode material tested against an industry relevant cathode material. The Polaris studies are part of the de-risking of the project and part of an approach to assessing the suitability of La Loutre graphite anode materials in a full-cell format. As the Company grows in its journey as a partner and developer of choice in Quebec, it will further review the applications for its graphite in North America and the energy transition.

Lomiko is completing the entire ‘rock-to-battery’ testing cycle as part of its Pre-Feasibility Study (“PFS”). The half-cell battery testing is now complete with exceptional results, and it is continuing with the graphite anode pouch cell construction and testing in Phase 2 with Polaris.

Concurrent with these studies, Lomiko is also working on the “NRC Study” announced on July 27, 2023, which aims to advance pre-feasibility level battery trials with its La Loutre natural flake graphite concentrate.

The Polaris Coin Cell Study

In “The Polaris Coin Cell Study”, cSPG batches were sent to Polaris in Oregon, USA, for battery testing, including half-cell coin and pouch battery testing. At this point, Lomiko is reporting only on the half-cell test results. Pictures of the half-cells made with Lomiko cSPG are pictured in Figure 1.

Figure 1. Lomiko graphite Half-cell batteries produced and tested by Polaris (SPG16 top, SPG20 bottom)

Highlights of this study:

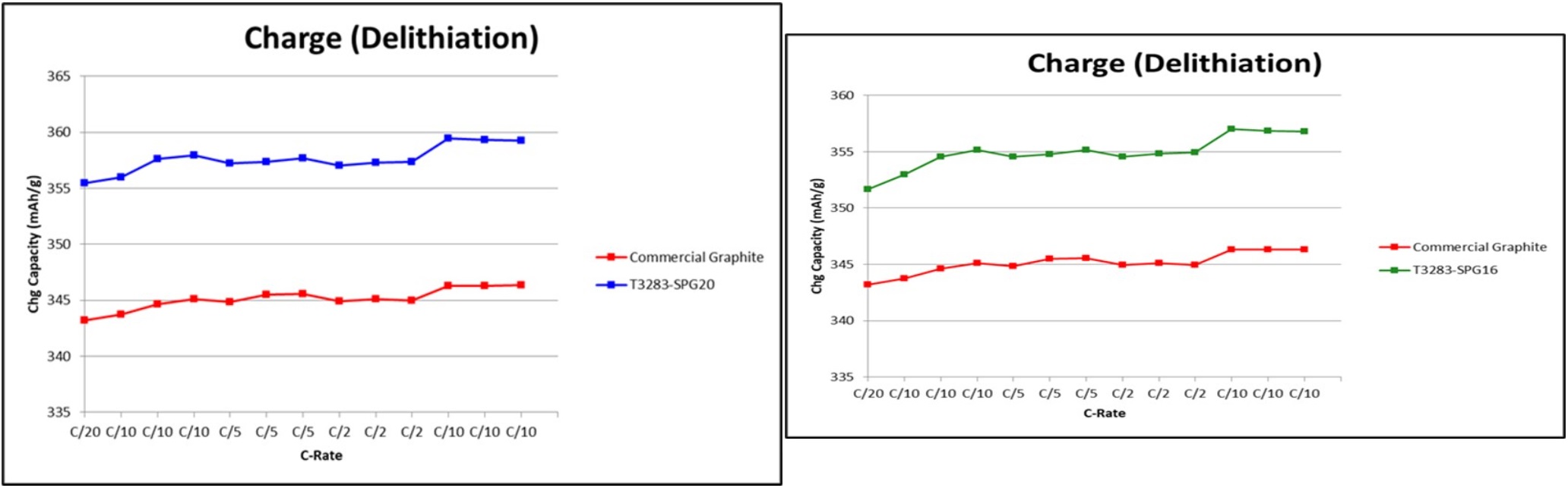

Reversible delithiation capacity at C/10 of ~356 mAh/g and ~358mA/h respectively, which is above the commercial reference graphite material testing at an average 345mA/h. C-rating describes the current the battery will deliver over the specific period, with C/10 being 10 hours.

All half-cell coin batteries were constructed using a batch of 20g of cSPG casted on a Cu current collector and 304SS CR2032 coin cell can components.

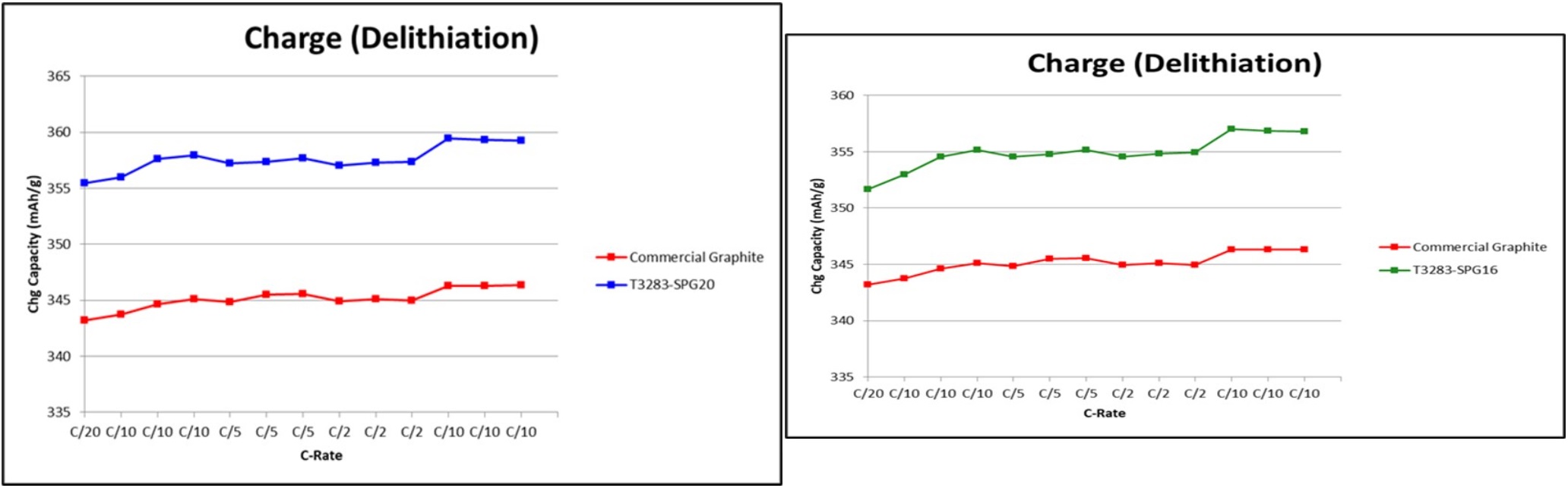

Figure 2 depicts the charging (delithiation) performance of the cSPG20 and cSPG16 samples from La Loutre, respectively, at different charge rates. The plots reveal the good performance of the La Loutre SPG with superior charging capacity compared to commercial graphite in the market today in North America.

Figure 2: comparison plot of sample SPG20 (left) and SPG16 (right) versus a commercial graphite reference

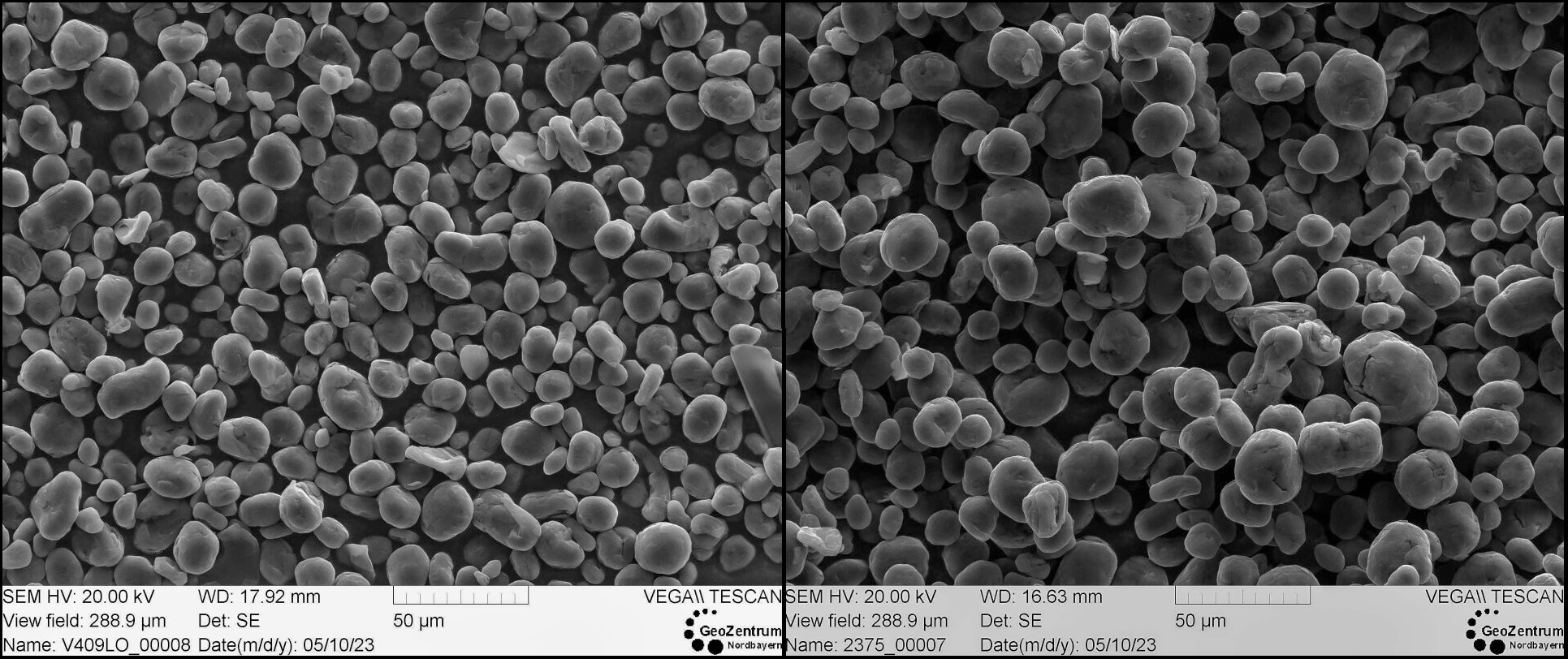

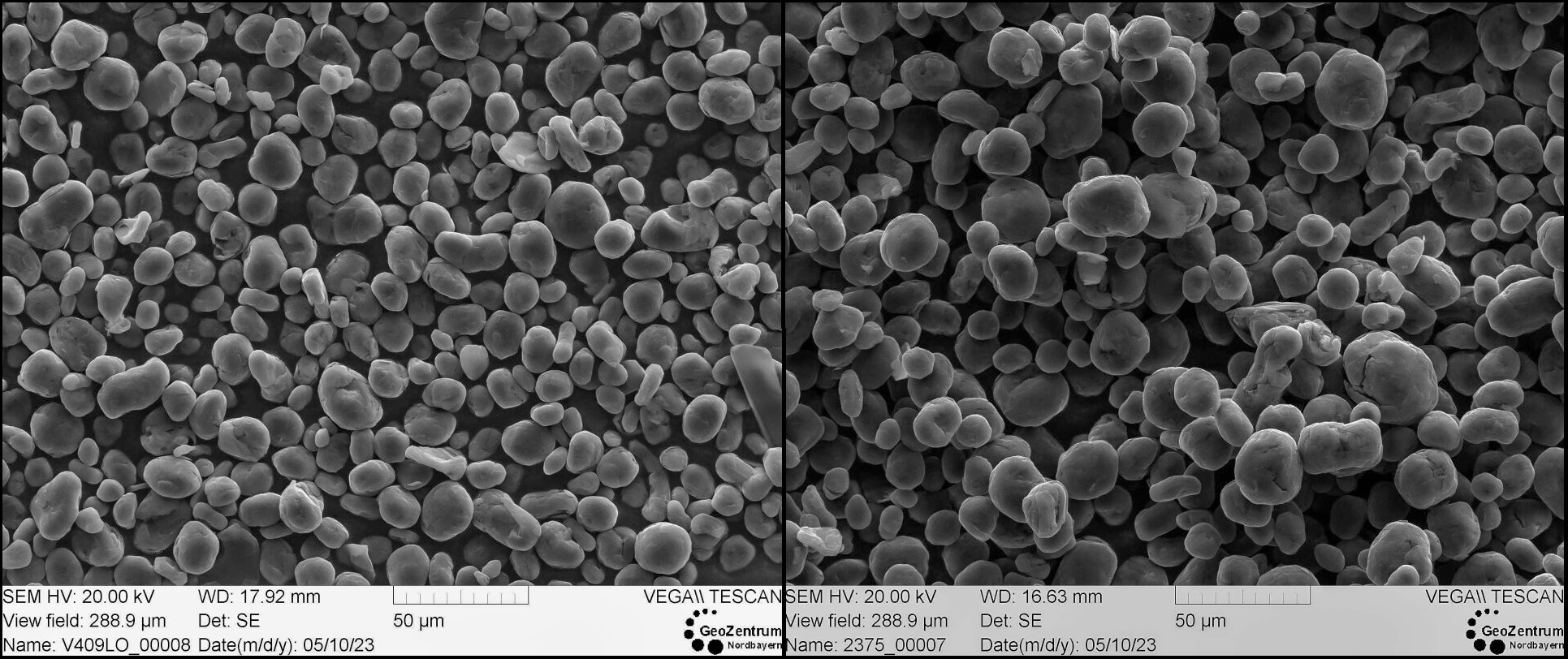

Both SPG16 and SPG20 (Figure 3) outperform the commercial reference in achievable gravimetric capacity which means that with the electrochemical performance results produced by Polaris, Lomiko has now successfully demonstrated the full value chain from ore to battery anode material on samples from the La Loutre project.

Figure 3: Scanning Electron Micrograph of Lomiko’s SPG16 (left) and SPG20 (right)

Phase 2

In Phase 2, cathode and prepared anode were combined into a single-layer pouch cell format to undergo electrochemical testing to demonstrate technical performance as a fully rechargeable battery. Note that the single-layer pouch cells provide a format that is similar to those used in industry while not requiring large amounts of active material. The coated spherical graphite material (cSPG) provided for the testing originated from coated purified samples generated by the Corem Innovation Centre in Quebec, Canada. These samples were micronized and spheronized by ProGraphite in Germany. The samples are deemed representative of the La Loutre deposit.

The single-layer pouch cells constructed with our graphite anode and standard cathode material demonstrated that our graphite performs well under basic test conditions: cSPG16 and cSPG20 samples from La Loutre reveal strong performance of the La Loutre cSPG with better discharging capacity compared to commercial graphite in North America today. Both samples were put through a brief life cycle analysis for 25 cycles at C/2 and performed well.

Polaris Single Layer Pouch Cell Study

Picture of the pouch cells made with La Loutre’s natural flake graphite:

Figure 4: Lomiko graphite single layer pouch cell batteries produced and tested by Polaris

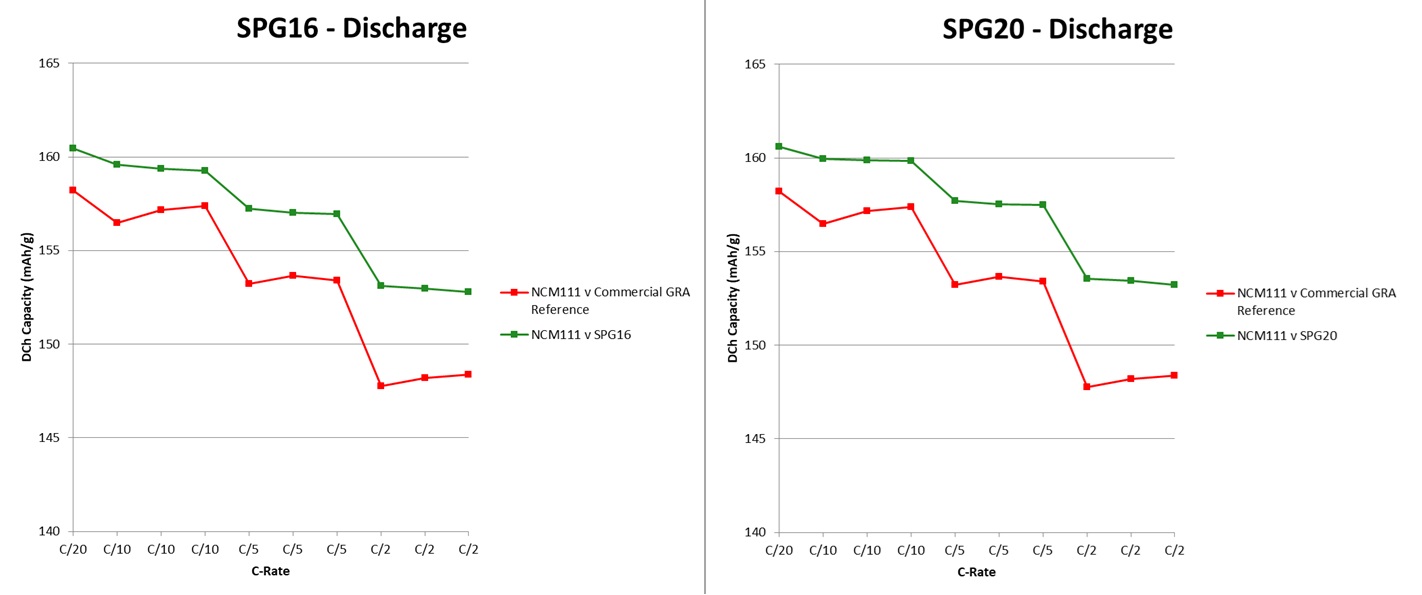

In Phase 2, Polaris constructed single-layer cells using the coated graphite materials paired with a cathode source. NCM111 was selected for this analysis. Preliminary cycling results indicate consistent performance with internal standard references, showing a relative capacity fade rate over 25 cycles at C/2 of less than 0.1% per cycle.

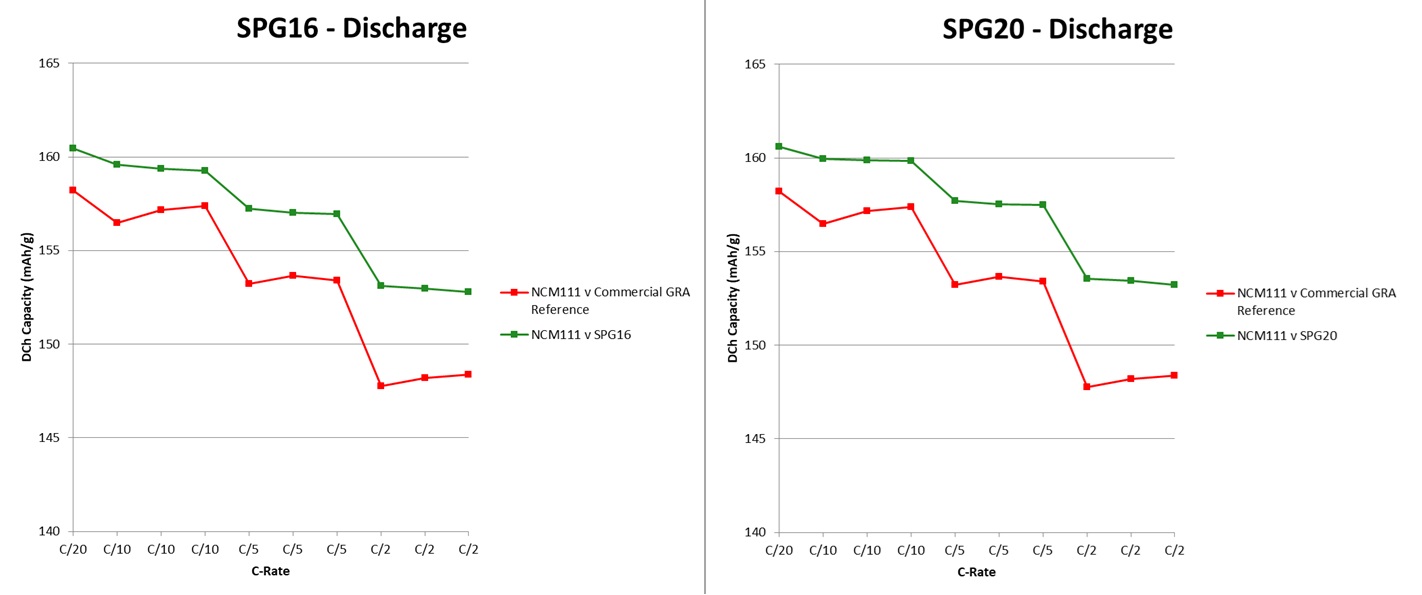

Initial cycling data suggests consistent performance with internal baseline performance metrics for an NCM111 cathode in a single-layer cell using commercially available natural graphite as the anode material. Figure 5 (left) shows a plot of an internal performance reference for an NCM111 vs. natural graphite single-layer cell in comparison to the single-layer cell using graphite batch SPG16. C/20 and C/10 data represent a boost in performance of ~1.5%, ~2.4% at C/5, and ~3.3% at C/2 versus the commercial reference. Further, SPG16 single-layer cells also demonstrate a lower degree of capacity loss at C-rate switches and more steady capacity at C-rate versus the commercial reference.

Figure 5: Plot of NCM111 vs a commercially available natural graphite reference in comparison to LOM’s SPG16 and SPG20 paired with an NCM111 cathode.

As observed in Figure 5 (right), initial cycling data indicates consistent performance versus a commercial reference.

In conclusion, both SPG16 and SPG20 perform well as compared to commercial graphite reference material for charge and discharge capacities, first cycle loss coulombic efficiency, and gravimetric capacity.

With these electrochemical performance results produced by Polaris, Lomiko has now successfully demonstrated the full value chain from ore to battery anode material on samples from the La Loutre project.

All metallurgical technical information was reviewed by the independent QP Oliver Peters from MetPro.

Next Steps

Continue work with CRITM Grant, Corem and NRC on a bulk sample testing and 500 cycle battery testing.