The Ontario Government revealed its new Critical Mineral Strategy on March 31, which will provide a roadmap for the province until 2027. The plan will have ramifications not only for mining in Ontario but for the growth of the industry in Canada as a whole. In this blog piece, we dive deeper into the main points of the strategy.

In past years, Ontario has pledged around $3.5 billion a year into the industry to help produce smartphones, batteries, and other electronics that are pivotal to the global green energy shift.

Ontario is home to a number of critical minerals, which have drawn prospectors and explorers for generations. Senior mining companies and investors, as well as senior nickel producers and investors, have flocked to the province seeking high-quality deposits. Ontario has the potential to become entrenched in the global critical minerals supply chain because of its mineral riches.

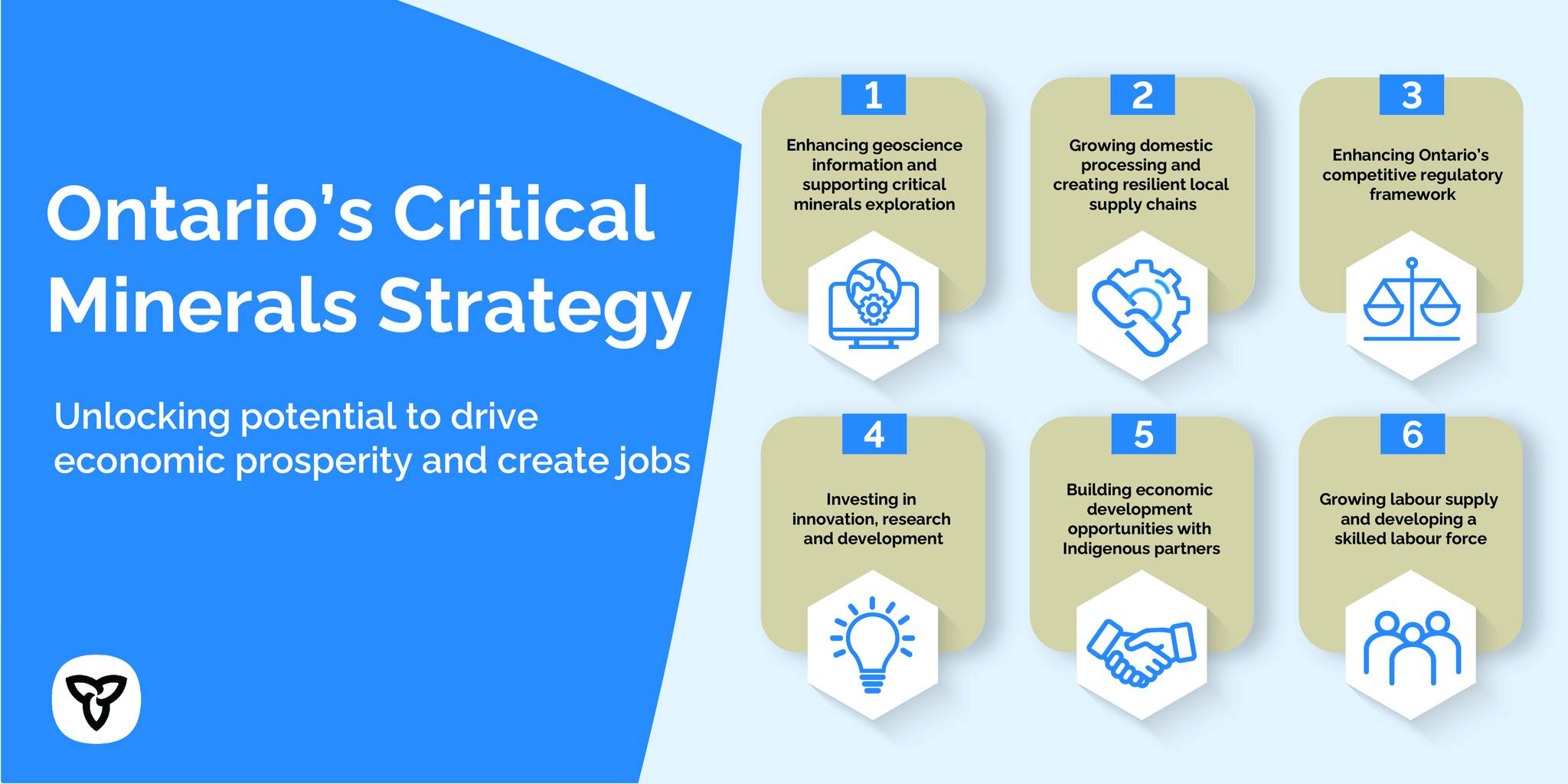

In the 53-page report that outlined the strategy, six pillars have been identified:

Enhancing geoscience information and supporting critical minerals exploration

High-quality, freely available geoscience information is critical to the success of grassroots mineral prospecting. An effort for new minerals discoveries will help ensure that Ontario continues to be a significant supplier of vital minerals.

Growing domestic processing and creating resilient local supply chains

The critical minerals supply chain is becoming increasingly concentrated in a few countries, which could expose Ontario’s economy to the risk of disruption. Countries such as Japan, South Korea, China, Germany have worked to establish critical minerals refining capacity as well as the required expertise and intellectual property to support advanced manufacturing and clean technology supply chains. Ontario is pledging to help build local chains that can help sustain the plan through 2027.

Improving Ontario’s regulatory framework

Mining companies operating in Canada are subject to various provincial and federal legislation and rules throughout the life of a mining project. To attract foreign investment, develop the sector, and create new employment, Ontario is dedicated to an effective and efficient legislative and regulatory framework.

Investing in innovation, research and development

Ontario is strengthening its position as an innovation centre, where cutting-edge technologies are being used to help several industries, including mining. Not only are mineral exploration and development firms creating the materials that will be utilized in important technologies in high-growth areas, but the mining sector itself is becoming increasingly technologically sophisticated. An investment in research projects and development collaborations will play a central role in the Critical Mineral Strategy.

Building economic development opportunities with Indigenous partners

Indigenous communities, mining companies, and governments all benefit from local projects and broader regional initiatives. Ontario will invest in efforts to help Indigenous communities and their members gain access to and profit from resource development through business and economic development training.

Growing labour supply and developing a skilled labour force

In February 2022, Ontario’s mining sector supported more than 28,000 direct and 47,000 indirect jobs in mineral processing and mining supplies and services. However, according to experts, the mining sector’s labour market pressures will continue to grow, and by 2025 the industry will need to hire between 30,000 and 48,000 new employees to fulfill its labour demands. Ontario is committed to enhancing the workplace of miners across the region with investment in local initiatives such as improved pathways into the mining industry.

Building a greener future today

In the report, Greg Rickford, Minister of Northern Development, Mines, Natural Resources and Forestry said that the strategy would help Ontario build a global supply chain in a greener future.

“Ontario is incredibly fortunate to be home to tremendous mineral wealth,” said Rickford. “This province is blessed with exquisite deposits of nickel, lithium, platinum, cobalt and dozens of other strategically important raw materials.”

He continued: “Many of these minerals have been identified by other countries as having geopolitical significance due to supply shortages or concentration of supply in very few countries. Global conflict has exacerbated these supply vulnerabilities and Ontario must step up to meet the soaring demand for critical minerals.”

“Our government’s vision for Ontario’s mining sector is to transform it into a leading producer of critical minerals. The Critical Minerals Strategy is our roadmap for driving this transformation and ensuring that Ontario takes its rightful place in the global supply chain for the economy of the future.”

Lomiko Metals is committed to exploring and graphite and lithium to supply North America’s rapidly expanding electric battery and green energy industries. Lomiko is actively developing two main projects in the province of Quebec: La Loutre, which is held 100% by Lomiko and is being explored for high-grade large flake graphite, and Bourier, which has been optioned by Lomiko and is being explored for lithium.

To find out more on Lomiko Metals and their latest critical mineral projects, visit lomiko.com